Trading with Relative Strength Index (RSI)

The relative strength index or the RSI is a momentum oscillator used to measure the velocity and magnitude of directional price movements. The indicator provides will help you determine overbought/oversold levels, as well as provide buy and sell signals.

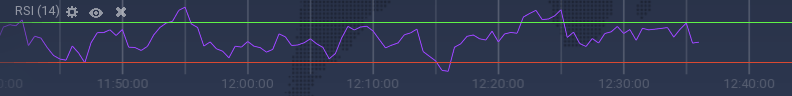

The RSI is basically a single line that fluctuates in the corridor between 0 and 100. The closer this line gets to the zero mark the higher are the chances for the asset to be oversold. When the RSI gets close to 100, the asset is likely to be overbought. According to the indicator, the asset price can be expected to appreciate once in the oversold zone and depreciate in the overbought zone.

How to use the RSI indicator in trading?

As noted above, the RSI oscillates between 0 and 100%. Traditionally the RSI is considered overbought when above 70% and oversold when below 30%. If the indicator provides a lot of false alarms it is possible to increase the overbought threshold to 80 and decrease the oversold threshold to 20.

J. Welles Wilder recommended a smoothing period of 14, which of course can be changed for the purposes of short- and long-term strategy adaptability. Shorter or longer periods are used for alternately shorter or longer outlooks.

The RSI is a universal indicator and can be used for the purpose of trading any assets from Forex to crypto and stocks.

Note that during strong trends the RSI can remain in the oversold/overbought zones for quite a long time!

Settings and Configurations

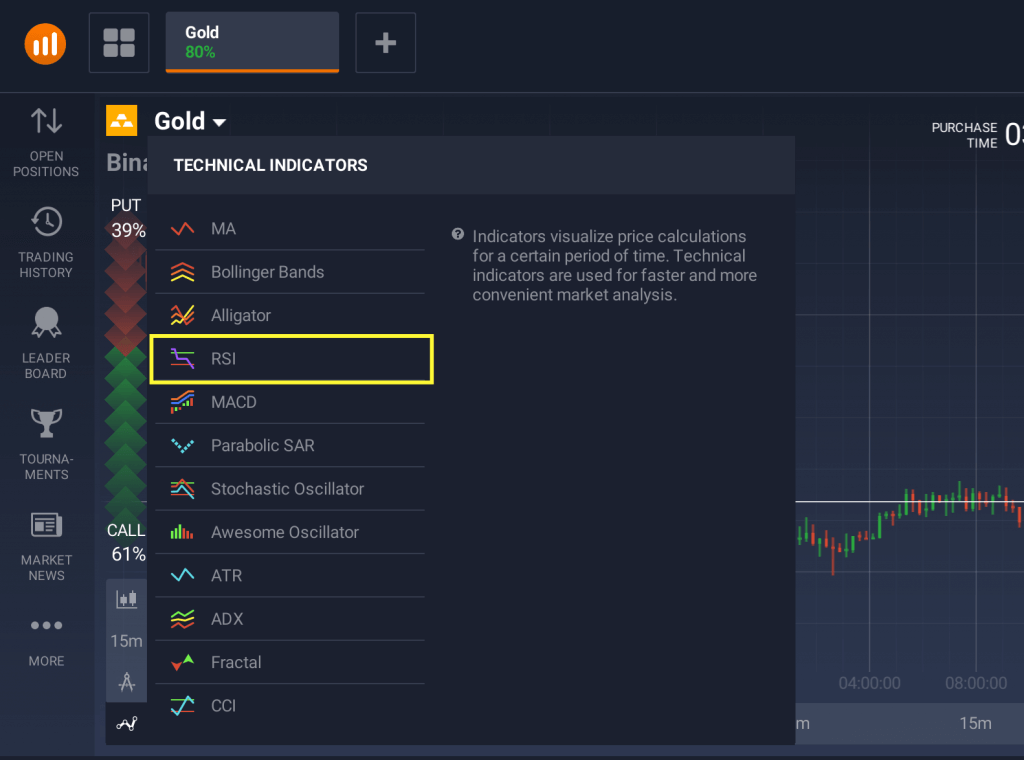

In order to use the Relative Strength Index simply do the following:

- Click on the “Indicators” button in the bottom left corner of the screen and choose the “RSI” from the list of available indicators.

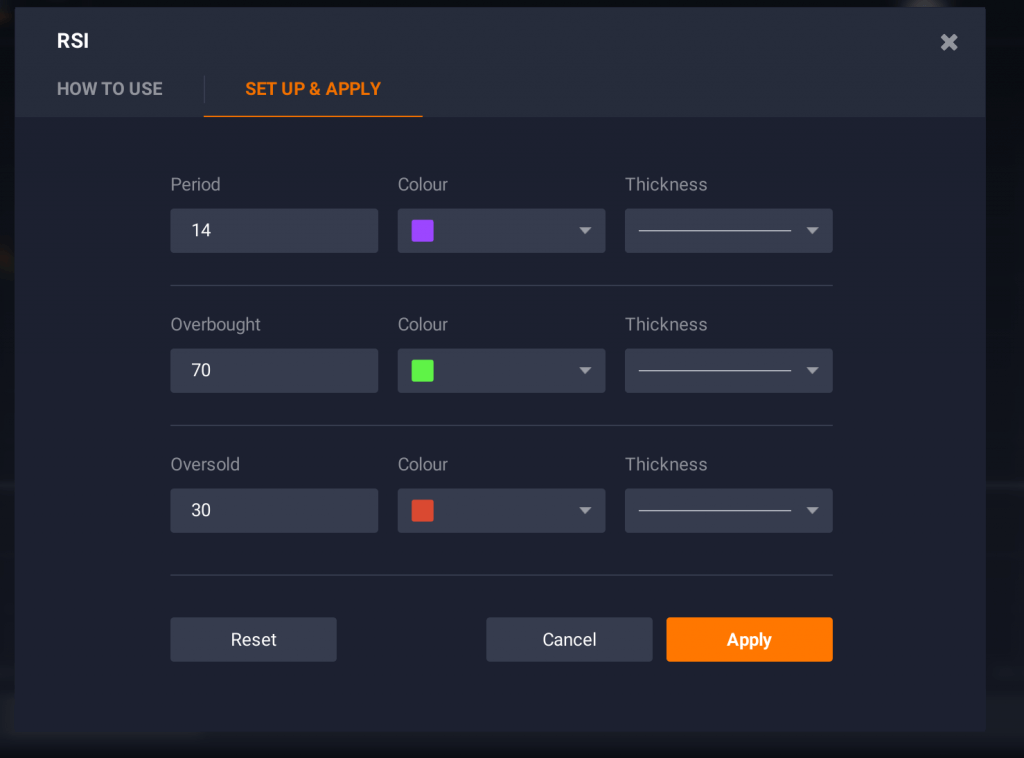

- Then push the “Apply” button if you prefer standard settings. The RSI graph will appear in the bottom part of your screen.

- Expert traders may find useful taking one more additional step and going to the “Set up & Apply” tab.

Optional: adjusting the settings. When setting up the indicator, you can adjust the period, overbought and oversold levels for more sensitivity/accuracy. Remember that the wider the corridor the fewer signals you get, but at the same time they will be more accurate. The opposite is the case if the threshold levels are closer to each other: the crossover signals will appear more often, but the number of false alarms will also increase. Remember that by increasing the “Period” parameter you are making the indicator less sensitive.

Standard approach — 70/30

The smoothing period of 14, oversold level 30% and overbought level 70% are used in the standard approach. This is the most frequently used preset for this indicator. Traders expect the RSI to bounce off 30 and 70 threshold lines. With standard parameters it will happen quite often, but it won’t always mean the actual change in the trend direction is coming.

Conservative approach — 80/20

The smoothing period of 21, oversold level 20% and overbought level 80% are advised by the conservative approach advocates. Risk-averse investors set up the indicator in a way that will make the RSI less sensitive and therefore minimize the number of incorrect signals. More extreme high and low levels — 90 and 10 — occur less frequently but indicate stronger momentum.

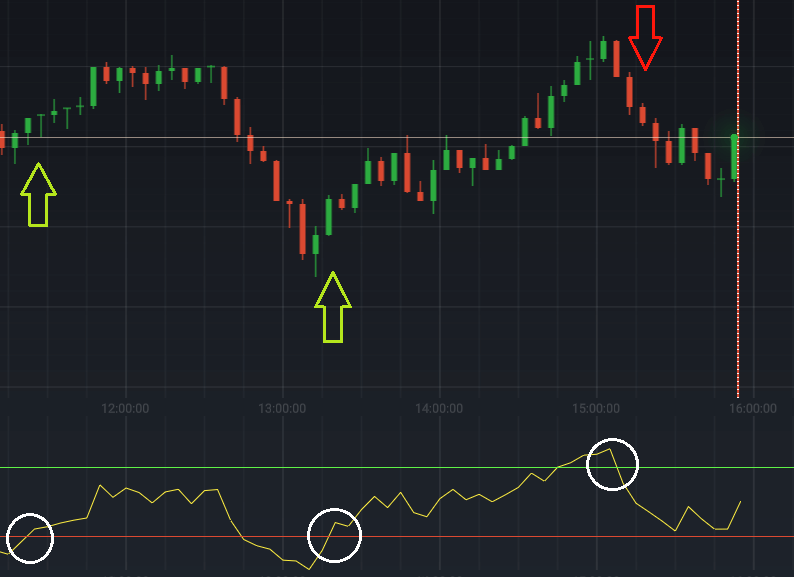

Divergence

Divergence is another way to use the above-mentioned indicator. If the movement of the underlying prices is not confirmed by the RSI it can signal a trend shift.

Divergence can be a good indicator of a coming price reversal. In the example above the price of the asset goes down, while the RSI demonstrates the opposite movement. This situation is followed by the trend shift.

Conclusion

The RSI is a powerful tool that can you determine optimal entry and exit points. Sometimes it can also predict the trend other indicators are too slow to acknowledge. However, it is rarely used on its own and should be combined with other indicators (say, Bollinger Bands or the Alligator).